What Everybody Ought To Know About How To Relieve Credit Card Debt

It’s been over the limit for some time, and during a.

How to relieve credit card debt. Rather than pay a company to talk to your creditor on your behalf, remember that you can do it. Those methods fall into two broad. You have $300 available to pay towards your debts.

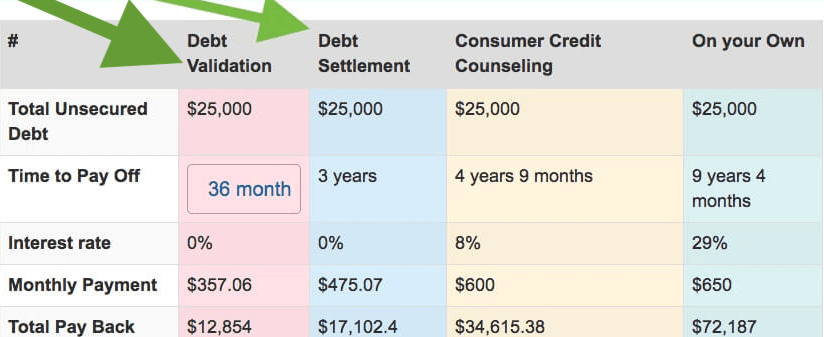

If you have credit card debt, you can open a balance transfer card with 0% apr and transfer your current balance to that card. While you assign the minimum payment to all other. Cut debt by 50% or more.

And depending on your credit situation and budget, some may be better than others. Talk with your credit card company, even if you have been turned down before. Get a credit card debt consolidation loan.

Card companies will offer 0% apr for a limited. Some prefer to live without a credit card and avoid the temptation to. In the avalanche method, once you pay off the minimum amount owing on all your debts, you then target the credit card debt with the highest interest rate.

If you can transfer that debt to a credit card offering 0% interest for at least 12 months, it'll cost less than $150 a month and reduce the amount of interest you'll have to pay. How should i pay off my credit card debt? There are several different ways you can tackle your credit card debt.

Consulting a credit counselor can provide help, if only to help you best understand your options. You may also get a call representative with a little more seniority or someone more experienced with credit card debt resolution. Borrowers with good to excellent credit that need more time to pay off their debt.

_1.jpg?ext=.jpg)